欧央行货币政策紧缩周期:经济增长与稳定的博弈

导读

2021年12月,欧洲中央银行正式启动了货币政策的紧缩周期,决定逐步缩减资产购买计划,并预计在2023年底之前将存款机制利率从负值区间提升至4%。这一历史性的转变象征着长达十年宽松货币政策的终结,背后驱动力源于俄乌冲突后全球经济格局的剧变和通胀的急剧攀升。欧洲央行的紧缩策略旨在有效应对通胀压力,稳定长期通胀预期,并在政策制定中审慎考量了货币政策的滞后效应、通胀的暂时性驱动因素以及经济环境的不确定性。

该动向对金融市场和银行业产生了深远的影响,主要体现在以下四个方面:

首先,市场利率结构发生显著变化。随着欧洲央行的加息和资产购买计划的缩减,货币市场、无风险利率、风险资产以及银行贷款利率均受到了直接冲击。金融市场对此迅速作出反应,实际利率成功转正,长期通胀预期稳定在2%左右,这充分表明了市场对欧洲央行政策决策的信任和认可。

其次,主权债券与汇率表现稳定。得益于PEPP(疫情紧急购买计划)和TPI(传导保护工具)等政策的支持,主权债券市场顺利适应了利率上升的节奏,确保了市场的平稳传导。在全球政策同步收紧的背景下,欧元兑美元汇率也保持了相对稳定。

第三,银行业与信贷市场面临调整。货币紧缩政策导致银行债券收益率上升,进而将更高的融资成本转嫁给借款人。虽然初期企业和家庭的贷款需求有所下降,但随着时间的推移,信贷市场逐渐趋于稳定。信贷调查显示,尽管高利率和增长疲软对贷款需求构成一定压力,但信贷标准似乎已逐渐趋于稳定。

第四,银行业的韧性得到增强。通过加强的银行监管和宏观审慎政策,银行业获得了更强的抵御风险能力,这有助于货币政策的有效传导和价格稳定的实现。

与此同时,经济活动也经历了曲折的复苏过程。欧洲央行的紧缩政策导致2023年经济活动一度放缓,但预计将在2024年初开始复苏。公共消费成为推动经济增长的主要动力,而私人消费和外部需求则相对疲软。从行业角度看,制造业和商业投资受到较大冲击,而服务业则展现出一定的韧性。

此外,通胀率逐步回落。欧洲央行的紧缩政策成功地将通胀率从2022年10月的峰值10.6%降低至更为可控的水平。预计至2025年中期,通胀率将稳定在2%的目标附近。通胀率的下降主要得益于能源通胀的降低、供应瓶颈的缓解以及货币政策的收紧。在欧洲央行的政策应对下,长期通胀预期得以保持稳定。

通过反事实研究,欧洲央行评估了自2022年以来收紧货币政策对通货紧缩的潜在影响。研究表明,紧缩政策预计将在2026年前使GDP增长率和通胀率每年降低约2个百分点。这一结论为欧洲央行未来的决策提供了重要的参考依据。

展望未来,欧洲央行将继续维持限制性利率以支持通货紧缩。在制定政策时,欧洲央行将充分考虑传导滞后、通胀预期以及经济平衡风险等因素。在确保通胀稳定的同时,欧洲央行也将努力避免对经济活动造成过度损害。通过审慎的决策和灵活的调整,欧洲央行致力于实现物价稳定和经济可持续发展的双重目标。

限于篇幅,以下为原文节选,全文见文末二维码。

作者丨Philip R. Lane(欧洲中央银行执行委员会成员)

展开全文

The analytics of the monetary policy tightening cycle

Guest lecture by Philip R. Lane, Member of the Executive Board of the ECB, at Stanford Graduate School of Business

Introduction

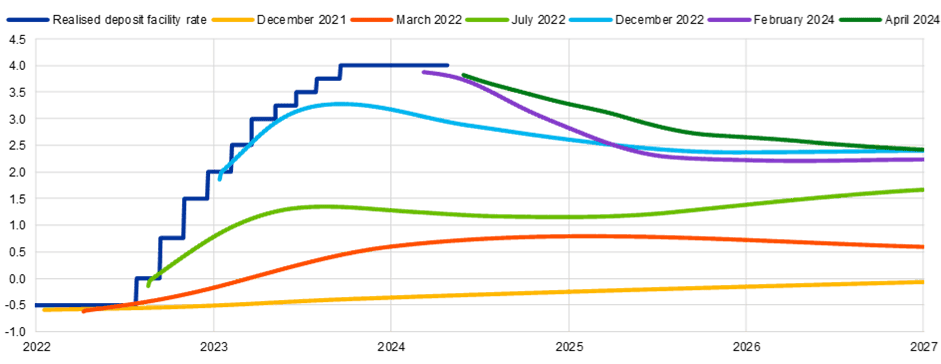

My aim today is to review the ECB’s monetary policy tightening cycle. The tightening began in December 2021 with the announcement of the end date for our net purchases under the pandemic emergency purchase programme (PEPP), as well as the recalibration and subsequent phase-out of our targeted lending programme. After concluding net purchases under the PEPP in March 2022 and net purchases under the asset purchase programme (APP) in June 2022, we subsequently normalised our policy rate (the deposit facility rate [DFR] in conditions of abundant excess liquidity) from -0.5 per cent to 2 per cent in the second half of 2022, before raising rates further into restrictive territory during the first nine months of 2023 to a level of 4.0 per cent. We have held the DFR constant at this level over the last five meetings since our last hike in September (Chart 1).

This was an especially striking tightening campaign in view of the prevailing highly-accommodative monetary stance, which consisted of very low levels of the policy rate that had been in place over the last decade, the considerable net asset purchasing under the APP since 2015 and under the PEPP since 2020 and the scale and pricing of the targeted long-term refinancing operations. In late 2021, this stance was still expected to be maintained over the medium term: for instance, the median respondent in the December 2021 Survey of Monetary Analysts expected the deposit facility rate to remain in negative territory until the first quarter of 2025 and net purchases under the APP to continue until June 2023. It follows that, relative the path expected in late 2021, the tightening cycle constituted a major surprise. Of course, the underlying driving force for the tightening cycle was the very large surprise increase in inflation, especially in 2022, after the unjustified Russian invasion of Ukraine. A defining feature is that a significant component of the stance tightening is expected to be persistent in nature, with rates only expected to descend to the neighbourhood of a more neutral level, while quantitative easing and targeted refinancing operations are not expected to be resumed.

Chart 1: Policy rate path and risk-free curve over time

(percentages per annum)

Sources: Bloomberg and ECB calculations.

Notes: The cut-off dates for the data used for the €STR forward curves are 17 December 2021, 11 March 2022, 22 July 2022, 16 December 2022, 9 February 2024, and 29 April 2024.

The aim of this lecture is to review this tightening cycle from an analytical perspective. The tightening cycle had two basic aims. First, during an extended period in which inflation was far above our target, it was imperative to unwind a monetary stance that would have been too accommodative relative to the rapid shift in expected inflation over the relevant policy horizon. Second, given the scale of the surprise inflation in 2021-2022, it was essential to contain the propagation of the inflation shock through the subsequent price-wage adjustment phases. While corrective waves of price and wage resetting were inescapable, a monetary stance that ensured that demand would be dampened and that inflation would return to the target in a timely manner would be needed to ensure an orderly adjustment phase that did not risk embedding above-target inflation into longer-term inflation expectations.

In calibrating the speed and scale of monetary tightening in the context of the post-pandemic recovery and extraordinary surge in energy prices (including due to the Russian invasion of Ukraine), several considerations were paramount.

First, lags in monetary transmission were inevitable: it would take time for monetary policy to exert its full impact on inflation.

Second, the descent of inflation from its peak would be assisted by the reversal of some of the factors driving the inflation surge: the easing of supply bottlenecks; the likely expansion of energy supply and contraction in energy demand in response to the spectacular increases in oil and gas prices; and the gradual re-normalisation of the economy through the fading out of pandemic-related distortions in sectoral supply and demand patterns. That is, the calibration of monetary policy should take account the temporary nature of some of the shocks, while making sure that these temporary shocks would not convert into permanent inflation through the de-anchoring of inflation expectations.

Third, the calibration needed to allow for various types of uncertainty. Along one dimension, there was uncertainty about the intrinsic persistence of the inflation process. In addition to the standard uncertainty about the feedback dynamics by which price increases in one period would trigger subsequent price and wage increases in following periods, the scale of inflation during 2022 also led to shifts in behaviour, with firms switching to more frequent pricing resets. While this added to the intensity of inflation, it also held out the possibility that the overall adjustment process could be front-loaded. Ultimately, the persistence of inflation would turn on the scale of de-anchoring of inflation expectations, which warranted close monitoring.

Along a second dimension, there was uncertainty about the strength of transmission of monetary policy in view of possible shifts in the economic, financial and monetary environment. First and foremost, the many years of low inflation and the strategic commitment by central banks to deliver the inflation target over the medium term provided a strong foundation for containing the inflation shock, compared to the costly de-anchoring dynamics observed in the 1970s. Compared to previous tightening cycles, it was also important to take into account trend shifts in: the sectoral composition of activity (which, among other things, can affect the overall degree of price rigidity in the economy, the interest sensitivity of demand and the overall sensitivity of activity levels to domestic demand); the state of the labour market; the scale of leverage among households and firms; the state of the banking system (which had been stabilised following regulatory reforms and intensified supervision with the introduction of the Single Supervisory Mechanism) in relation to capital levels, the risk profiles of loan books (including due to the beneficial impact of borrower-based macroprudential measures) and bond holdings, together with the risk profile of liability structures; and, finally, structural exposures to interest rate movements (with a substantial increase in the share of fixed-rate mortgages).

In addition to trend shifts, the pandemic itself had resulted in lower leverage and more robust balance sheets, due to forced savings during the pandemic and the scale of fiscal transfers to households and firms. Furthermore, monetary tightening could be taking hold at the same time as a projected rebound in economic activity might protect employment levels, with firms holding onto workers in anticipation of post-pandemic normalisation. Working in the opposite direction, Russia’s unjustified war against Ukraine had triggered a major increase in economic uncertainty, while the surge in imported energy prices constituted a major terms of trade shock that substantially reduced real incomes and purchasing power: these forces were independently likely to dampen consumption and investment for any given level of monetary restriction.

Along a third dimension, the nature of the monetary configuration also created uncertainty about the tightening process. After many years of expanding the central bank balance sheet (which had further accelerated during the pandemic), the required shift in the monetary stance called for an exit from net asset purchases and a pull back from the longer-term refinancing operations that had pumped liquidity into the banking system, in addition to the lifting of the policy rate. In the absence of historical benchmarks for this exit process, there was a wide range of views about the possible impact on the financial system. In addition, since both balance sheet normalisation and the lifting of policy rates were simultaneously proceeding at a global level, there was also uncertainty about the strength of international spillovers in the tightening process.

A final uncertainty dimension related to the modelling of monetary policy. The ECB maintains a suite of macroeconomic models in order to provide robust underpinnings for forecasting and policy analysis. The projected impact of shifts in monetary policy varies across these models, in line with differences in the specification of the economic and financial environment and, crucially, in the sensitivity of inflation expectations to policy actions.

Taken together, these various types of uncertainty underlined the importance of taking a data-dependent approach to the calibration of monetary policy that would take into account the evolving inflation outlook, the realised path for underlying inflation indicators and the incoming evidence on the strength of monetary policy transmission.

I will now provide an analytical review of the transmission of monetary policy tightening to: the financial and banking systems; the economy; and, finally, inflation. I will also briefly draw some lessons from the tightening period for the conduct of monetary policy during the next phase of the cycle.

扫面二维码阅读全文

编译:周杼樾

监制:崔洁

来源|欧洲中央银行

版面编辑|刘佳艺

责任编辑|李锦璇、蒋旭

主编|朱霜霜

近期热文

张东刚:新质生产力的理论创新、形成机理与未来展望

克服“规模情结”,看待当前货币供应增速新变

稳步加大保障房建设金融支持力度

【会议简报】释放新质生产力与大湾区国际创新中心建设

中国人民大学国家金融研究院举行专家聘任仪式

评论